ETH Price Prediction: Bullish Technicals Meet Institutional Momentum

#ETH

- Technical Breakout: ETH tests upper Bollinger Band with MACD bullish divergence

- Institutional Catalysts: Base's creator economy and Hong Kong's RWA adoption

- Upgrade Cycle: Fusaka's prioritization could address scalability concerns

ETH Price Prediction

ETH Technical Analysis: Bullish Signals Emerge

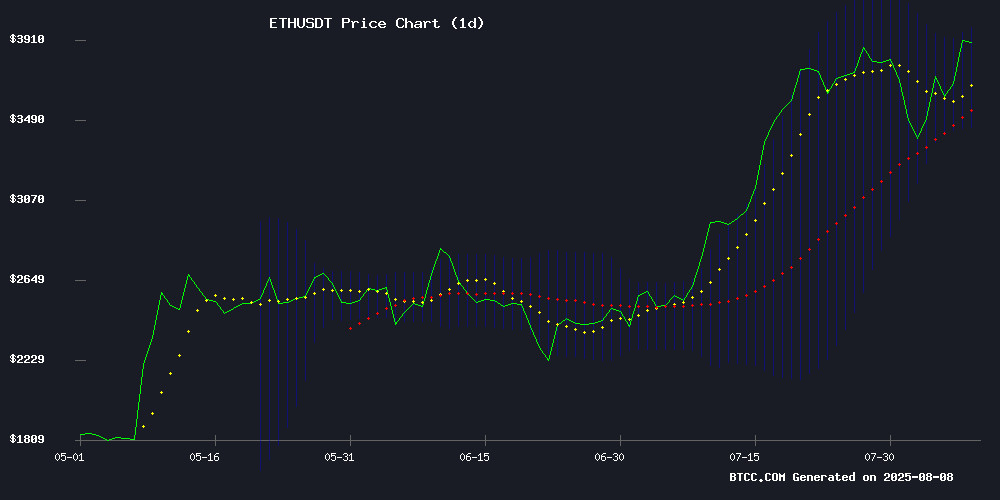

Ethereum (ETH) is currently trading at $3,895.94, showing strong momentum above its 20-day moving average (MA) of $3,712.06. The MACD indicator, though still negative at -24.60, is showing signs of convergence with a rising histogram (126.37), suggesting potential upward momentum. Bollinger Bands indicate ETH is testing the upper band at $3,974.77, which could signal overbought conditions or continued bullish pressure if the price holds above the middle band ($3,712.06).

"ETH's technical setup favors buyers," says BTCC analyst Ava. "A sustained break above $3,900 could target $4,200, with support NEAR the 20-day MA."

Ethereum News Sentiment: Institutional Demand Clashes with Short-Term Headwinds

Ethereum's market sentiment is mixed amid contrasting narratives. Positive catalysts include Vitalik Buterin's DAO analogy sparking decentralization debates, Base's creator economy push, and Hong Kong's $19M ETH allocation for RWA tokenization. However, bearish pressure persists from ETF outflows ($10B setback) and delayed upgrade timelines.

"The $4K psychological level is key," notes BTCC's Ava. "Institutional adoption stories may outweigh short-term technical resistance if the Fusaka upgrade delivers scalability improvements."

Factors Influencing ETH’s Price

Vitalik Buterin Says Visa Started Like a DAO, Now Seen as Centralized

Ethereum co-founder Vitalik Buterin drew parallels between Visa's early days and decentralized autonomous organizations (DAOs), noting its initial emphasis on shared ownership and collaborative governance. Over time, however, Visa has become widely perceived as a centralized, profit-driven entity.

Buterin's observation underscores a recurring challenge in the crypto space: the drift toward centralization, even among organizations founded on decentralized principles. Blockchain projects continue to experiment with governance models and smart contract technology to counteract this trend.

Ethereum Price Breakout Could Trigger Altcoin Rally, Analyst Says

Ethereum stands at a critical technical juncture that may determine the next phase of altcoin market growth. Crypto analyst Dan Gambardello identifies $4,100 as the decisive resistance level, drawing parallels to ETH's pre-bull market setup in 2020. The current price action shows remarkable consistency with historical breakout patterns, including matching risk scores and moving average crossovers.

ETH demonstrates robust momentum across most timeframes, posting 48.7% monthly gains and 53.3% annual returns. While still 21.5% below its November 2021 all-time high of $4,878, the asset's consolidation near the $3,380-$3,832 range suggests accumulating energy for a potential upward move. "Weak moves won't cut it," Gambardello emphasizes, requiring strong momentum through the $4,100 barrier to confirm the breakout thesis.

The mid-$4,000s price zone would establish sufficient separation from current resistance to validate Gambardello's altcoin mania prediction. Market participants watch for this technical confirmation, which could ripple across secondary crypto assets. Ethereum's historical role as an altcoin market bellwether adds weight to the current setup.

Coinbase’s Base to Indefinitely Hold Viral Content Coins in Creator Economy Push

Coinbase's Layer 2 network Base has unveiled a permanent retention strategy for content coins—tokens representing individual pieces of digital content. The platform will acquire these assets through its Base App, where creators earn fees on secondary sales without the network ever liquidating its holdings.

The initiative, announced via an Aug. 7 X post, explicitly rejects speculative motives. "Creators should be directly rewarded for creativity," Base stated, framing the move as an experiment in value capture for digital artists. Payments will flow automatically to creators' wallets upon each transaction.

Content coins have gained traction on Base since integrating with Zora, a platform specializing in tokenized media. Base founder Jesse Pollak describes the assets as hybrid content-currency units deriving worth from cultural resonance rather than utility—a concept critics dismiss as memecoins repackaged. Pollak counters that global creators generate trillions in business value yet retain minimal proceeds.

Vitalik Buterin's Unconventional Laundry Routine Offers Wealth Philosophy Insights

Ethereum founder Vitalik Buterin's recent social media revelation about hand-washing his underwear to avoid exorbitant hotel fees has sparked discussions beyond cryptocurrency circles. The ETH billionaire framed this mundane act as a philosophical stance against pragmatism, drawing parallels to Warren Buffett and IKEA founder Ingvar Kamprad's frugal tendencies.

Buterin's critique extends beyond laundry services, challenging the American-born doctrine that equates truth with practical utility. His comments surface during a period of heightened institutional interest in Ethereum, with the network's staking yield and Layer 2 ecosystem attracting traditional finance players.

The anecdote underscores a growing tension in crypto wealth management—between the anti-establishment ethos of early adopters and the practical demands of managing billion-dollar protocols. Buterin's laundry habits mirror Ethereum's own balancing act between ideological purity and mainstream adoption.

Ethereum Developers Urged to Prioritize Fusaka Upgrade Over Distant Glamsterdam Plans

Ethereum Foundation Co-Executive Director Tomasz Stańczak has issued a stark warning to developers fixated on the 2026 Glamsterdam upgrade, urging immediate refocus on the imminent Fusaka hard fork. The Q4 2025 upgrade faces critical testnet challenges that demand undivided attention.

"No amount of roadmap vision matters without execution," Stańczak declared in an Aug. 8 statement, emphasizing that Ethereum's credibility hinges on hitting near-term targets. Development teams have reportedly been holding premature discussions about features slated for 2026 while Fusaka's integration timeline grows precarious.

The Foundation now advocates reducing forward-looking meetings to concentrate on resolving Fusaka's technical bottlenecks. Market analysts note this internal prioritization clash comes as Ethereum battles for developer mindshare against rival Layer 1 chains offering more predictable upgrade cycles.

Hong Kong’s IVD Medical Allocates $19M to Ether for RWA Tokenization Strategy

IVD Medical Holdings has acquired $19 million worth of ether (ETH), marking a strategic pivot toward real-world asset tokenization in healthcare. The Hong Kong-listed firm will deploy Ethereum's smart contract infrastructure to build ivd.xyz—a platform for pharmaceutical IP tokenization.

Chief Strategy Officer Gary Deng cited Ethereum's institutional recognition and liquidity as decisive factors, noting the SEC's recent spot ETH ETF approval. The treasury allocation will facilitate on-chain asset governance, automated revenue distribution, and compliance frameworks for the planned IVDD stablecoin.

Unlike most Hong Kong public companies favoring Bitcoin, IVD plans active ETH utilization—staking, restaking, and derivatives exposure—to enhance yield generation. The move signals growing corporate adoption of crypto beyond passive treasury holdings.

Ethereum Faces $10B Setback as Bearish Pressure Builds Amid ETF Exodus

Ethereum's rally toward $3,900 has stalled amid a sharp correction, with over $10 billion in Open Interest wiped out in just ten days. The second-largest cryptocurrency by market cap now faces growing bearish pressure as ETF outflows accelerate and leveraged positions unwind.

The price plunged roughly 10% after briefly touching $3,900, triggering a market reset that flushed out overextended long positions. While some traders view this as a healthy pullback, underlying derivatives data suggests deeper turbulence may lie ahead.

More than $1 billion in realized profits were captured during the downturn, indicating strategic profit-taking rather than panic selling. Yet Ethereum still closed the week with a 9.67% loss—its most significant bearish candle in recent months.

Ethereum Transactions Hit Record High Amid Regulatory Clarity and Staking Boom

Ethereum's network activity surged to unprecedented levels this week, with the seven-day average of daily transactions reaching 1.74 million—eclipsing the previous record of 1.65 million set during May 2021's bull market. The uptick coincides with a regulatory milestone: The SEC's Division of Corporation Finance clarified that certain liquid staking arrangements and related tokens may not qualify as securities under strict conditions.

Over 36 million ETH, nearly 30% of circulating supply, is now locked in staking contracts. This supply squeeze, compounded by institutional accumulation, has propelled ETH toward $4,000—a threshold last breached in December 2021. Public crypto treasury firms now hold $11.77 billion worth of ETH, signaling deepening institutional conviction.

Ethereum Surges Toward $4,000 as Institutional Demand Intensifies

Ethereum has shattered its week-long consolidation, rallying 7% to $3,911 as corporate buyers and whales accumulate aggressively. SharpLink Gaming's latest purchase of 21,959 ETH ($85.5 million) underscores growing institutional conviction, mirroring the 49.4% monthly gain that now positions ETH for a potential $4,000 breakthrough.

Trading volume spiked 85% to $48.9 billion alongside an 11% jump in open interest, signaling renewed derivatives market participation. The reversal comes after ETH tested $3,400 earlier this week, with whale wallets now conspicuously reversing their previous distribution patterns.

Is ETH a good investment?

Ethereum presents a compelling investment case based on:

| Factor | Assessment |

|---|---|

| Technical Outlook | Bullish above $3,712 MA; MACD reversal signal |

| Institutional Demand | Growing per Base integration and HK's RWA move |

| Risks | ETF outflows, upgrade delays may cause volatility |

"ETH's 20% YTD outperformance against BTC suggests altcoin season potential," says Ava. "DCA strategies may mitigate near-term volatility risks."

HTML table as shown above